Lessons from The Fortune 100 : 1955 - 2020

What I learnt analysing every Fortune 100 list since 1955.

I started this project because I randomly came across a Fortune 100 list and saw Walmart made $523B in 2020. One thing led to another, and I suddenly found myself curious about every company on every Fortune 100 list, and well, here we are.

Methodology

I scrapped 66 websites (found here, here, and here), cleaned and labelled the database by myself (for those curious it was a nightmare). I will be making the database free and publicly available sometime next week (week commencing 14th), or the week after (week commencing the 21st).

I did not take into account mergers and acquisitions e.g I left AT&T and Time Warner as separate companies. However when doing aggregate analysis I will refer to the current parent company / new organisation (if applicable) e.g I will refer to Exxon (prior to its merge with Mobil) as ExxonMobil, for ease of understanding and clearer analysis.

I calculated America’s 2020 annual CPI value by finding the average value of the available January - October CPI values.

Revenue for 2015 was unavailable, and therefore all analysis involving revenue has the year 2015 omitted. Other than that every year from 1955 - 2020 is included.

For company’s that have since pivoted into new sectors and abandoned their previous sector, I labelled them as the initial sector they were in.

For conglomerates I labelled them as the sector they were most known for.

For holding companies I labelled them as finance companies.

I placed each company into one of the following sectors:

Manufacturing - A company involved in the conversion of raw physical or chemical material into a product. I used this to help label manufacturing companies.

Energy - A company involved in the production or distribution of energy solutions (services or products).

Media - Anything that consists of film, print, radio, and television.

Construction - A company involved in the delivering of buildings, infrastructure and industrial facilities.

Retail - A company involved in the process of selling consumer goods or services to customers through multiple channels of distribution.

Unknown - Companies I could not find (with confidence) on Google, and therefore left their sector as unknown.

Finance - A company that predominantly provides financial services to people and/or corporations.

Technology - A company that uses software and/or hardware to manipulate and/or distribute information in the form of a product or service.

Pharmaceutical - A company that discovers, develops, produces, and markets drugs or pharmaceutical drugs for use as medications to be administered to patients, with the aim to cure them, vaccinate them, or alleviate the symptoms.

Healthcare - A company that provides medical services, manufactures medical equipment, or otherwise facilitates the provision of healthcare to patients.

Transportation - A company that deals with the movement of people and products. These include companies such as airlines, trucking, railroads, shipping, and logistics firms.

Apparel - A company that predominantly designs and sells clothing, footwear and/or accessories.

Hospitality - A company that is either a hotel, restaurant and/or bar.

Analysis

373 companies have featured on the Fortune 100, of which only 14 companies featured on both the first Fortune 100 list in 1955 and the 2020 Fortune 100 list.

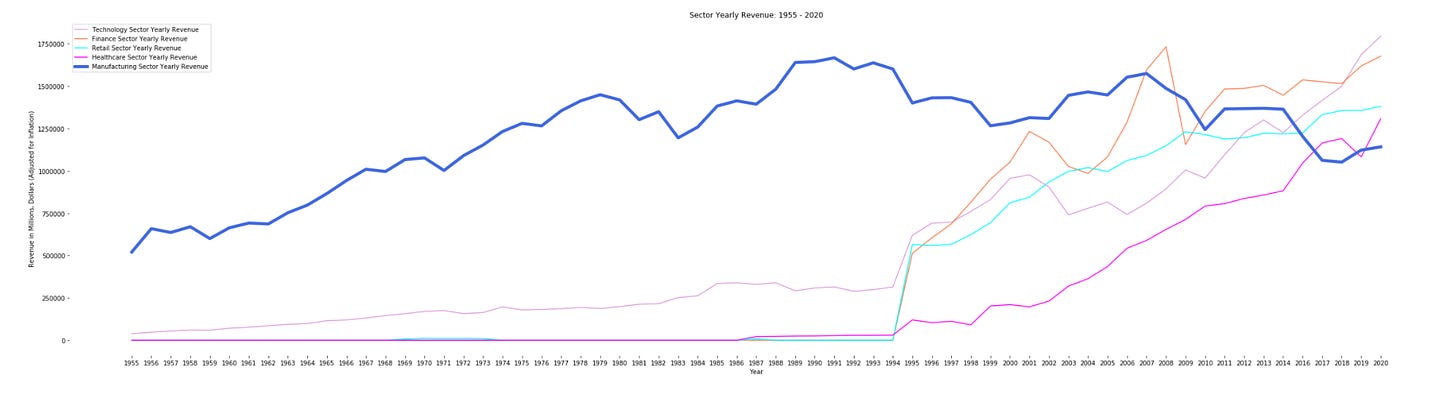

12 sectors (not including “unknown”) have made up all 66 Fortune 100 lists. Somewhat surprisingly (or unsurprisingly), the Manufacturing sector has made up nearly 50% of all the Fortune 100 list for the past 66 years, with the energy, technology and finance sectors following quite far behind.

However, here is where it gets really interesting. Although the Manufacturing sector has made up nearly 50% of all combined Fortune 100 lists, its total revenue contribution amounts to just less than a 1/3rd of total revenue made. Retail punched way above its weight, having only represented 4.3% of all Fortune 100 lists but contributing nearly 10% of all revenue made.

Who’s number one?

The no.1 spot has rotated amongst three companies - General Motors,Walmart and ExxonMobil (known as Exxon up until its merger with Mobil in 1998).

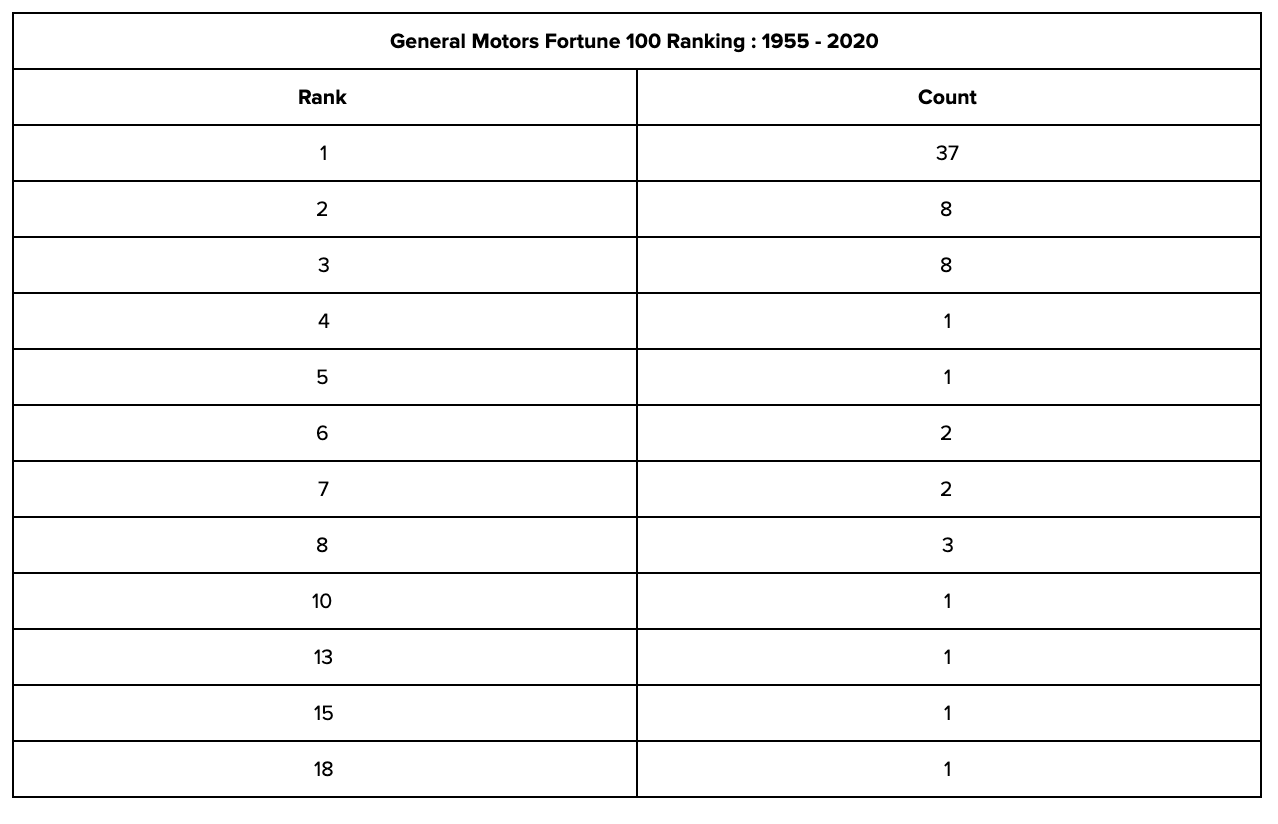

General Motors Ranking

General Motors has been no.1 a whooping 37 times! It first became no.1 in 1955, the year the fortune 500 list was founded, and has remained part of the list every year since. It achieved its lowest rank in 2020 placing 18th, having been ranked 13th in 2019. Fun fact, they have been no.1 for more than half of the history of the Fortune 100 (66 years).

The 2008 crash took a real toll on General Motors. In 2007 it earned $258,564.10M (adjusted for inflation). By 2010 it earned $123,989.11M, experiencing an approximate 52% decrease in revenue. Today it only out-earns its Fortune 100 sector by 2.2x , and the gap doesn’t look like it’ll be widening any time soon.

Walmart Ranking

Walmart has been no.1 16 times. Fun fact, Walmart was founded in 1963 making it the youngest company in this sub category (companies that have been no.1) and first joined the Fortune 100 list in 1995. Walmart is currently no.1 on the Fortune 100 list, having been no.1 for the past 8 years consecutively (who the hell would have guessed that?!).

When comparing the average revenue per year of the Fortune 100 Retail sector to Walmart, Walmart has out performed its sectors’ average by approximately 4x for the last 10 years. To understand why that is, we first have to go back to the year before they first entered the Fortune 100 list in 1994. In 1994 Walmart expanded into Canada with its acquisition of 122 Woolco stores, to which Woolco received $300M in cash. In 1996, it opened its first store in China, in 1998 it bought Asda and in 2000 Walmart.com was founded, which allowed customers to shop online. Essentially, from 1994 onwards, it was years of aggressive international expansion for Walmart through a series of heavy acquisitions and partnerships.

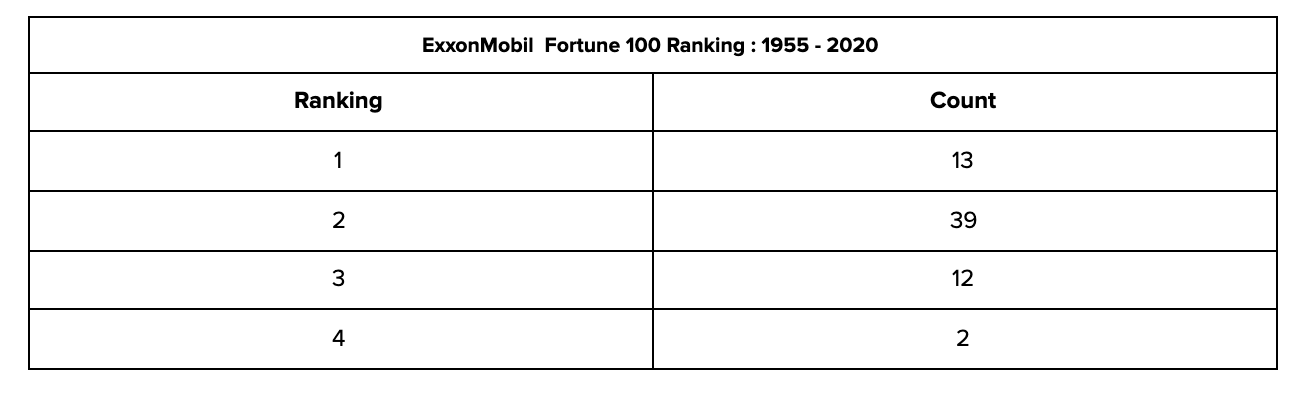

ExxonMobil Ranking

ExxonMobil has been no.1 13 times and has never received a ranking lower than no.4. Fun fact, ExxonMobil was originally known as Standard Oil Company of New Jersey, however due to antitrust laws it was dissolved and broken up into Exxon, BP and Chevron.

Unlike Walmart, ExxonMobil only outperforms its sectors’ revenue by approximately 2.8x as of 2020, which is not bad by any means, but it doesn’t look like it will be getting better any time soon. They experienced ~55% drop in revenue between the years 2012 and 2017, going from $459,926M to $205,004 (adjusted for inflation).Why the decline? The short answer is that 2012 was the year of many different oil crises. If you would like to know more I would recommend reading this article.

What happened in 1994?

We briefly spoke about Walmart’s 1994 rise, but upon closer inspection it looks like something interesting happened in 1994. It was the year technology (baby pink), finance (orange), retail (turquoise) and healthcare (hot pink) started to take off (fun fact, this was also the year Amazon and Yahoo were founded), but why?

Events in Technology - 1994

The birth of the world wide web.

The first conference devoted entirely to the subject of the commercial potential of the World Wide Web opens in San Francisco. Featured speakers include Marc Andreessen of Netscape, Mark Graham of Pandora Systems, and Ken McCarthy of E-Media.

Netscape Communications was formed, helped by the launch of its browser, Navigator.

The Nokia 1011 was created, making it the first mass produced GSM phone. Before that phones were very large and hard to carry around.

The Sony playstation was created and first released in Japan. A couple years later (1996) the first Nintendo was released.

In 1994 there were no telecommunication companies on the Fortune 100 list (I categorised these as technology companies).

In 1995 there were 9 telecommunication companies in the Fortune 100 and AT&T shot up to replace International Business Machines (IBM) as the highest ranking Technology company of the year. Ironically, Nokia did not make the list.

Events in Finance - 1994

In 1994 there were no finance companies in the Fortune 100 list. By 1995 there were 14 different financial companies on the fortune 100 list (Chase Manhattan and Bank of America appear twice, this is how it appears on the original list I sourced the data from).

Prior to 1994 there was a law that effectively prohibited federal chartered banks from interstate banking. The law was repealed in 1994 and federal banks were now allowed to achieve geographic diversification.

Retail

In 1994 there were no Retail companies on the Fortune 100 list. In 1995 there were 13 on the list, with Walmart ranking 4th.

Upon first glance, it seems as though the Retail sector was going through a period of rapid expansions via acquisitions e.g Walmart’s acquisition of Woolco Canada and Home Depot’s acquisition of Canada’s Aikenhead's Hardware in 1994 for $150 million. Unfortunately, however, this hypothesis does not hold true. In 1994 Safeway sold more than half of its stores, Sears underwent serious restructuring and divesting of its unprofitable businesses, and Costco expanded to Korea in 1994, with its next international expansion happening in 1997. The point being that either a) there is no relationship between these companies and their coinciding rise or b) the relationship is more complex than expected, and therefore harder to identify.

Healthcare

In 1994 there were only 2 Healthcare Fortune 100 companies.

In 1995 there were 5 companies.

Again, the relationship here is not entirely clear - if you have a hypothesis/answer, I would love to know!

Funnily enough, the rise of these four industries yearly revenue, coincided with the decline of the Manufacturing (dark blue) sectors dominance on the Fortune 100 list.

From 1955 to 1994 the Manufacturing sector accounted for a large majority of the Fortune 100 list, totalling nearly 70% of the list at its peak. Upon further inspection it doesn’t look like anything major actually happened to the Manufacturing sector between 1993 and 1995. It looks like other industries simply started making more money, whilst Manufacturing remained somewhat stagnant.

Today the Fortune 100 list is pretty diversified, being split across 12 sectors. Finance (orange) leads at 23% of the list, followed by Manufacturing (dark blue) at 18% and Technology at 16% (baby pink).

It is not entirely obvious what happened in 1994, but it’s a question worth answering and I encourage anyone reading this to explore it (if their curiosity leads them and time permits)

Final Thoughts

I don’t have any fancy or insightful predictions to give but I will say I was shocked by both Finance and Technology’s performance. I expected much less from Finance, and much, much more from Technology. If there is one thing I have learnt, it is that I am definitely living in a (technology) bubble.

The biggest shock of all (and the inspiration behind this project) was seeing the financial success of Walmart. Prior to this project I had no idea how much money they made, nor how consistent they were. One can only imagine what they will look like in 10 years time.

That being said, although Amazon is currently making just over half of what Walmart makes (no.2 on the list), I do expect to see them take the no.1 in the next 10 years.

Who do you think will be no.1 in 10 years time and what sectors do you think will dominate, if any? Drop a comment below or email me adaobiadibe23@gmail.com, I’d love to know!

Insightful!